How can optimizing payment processes shape the future of banking?

Profile of Participants:

C-level, Directors and

Higher-management

Benelux

Banks and Financial Institutions

Unveiling Payments Potential and Empowering Banks for the Future

In the ever-evolving landscape of banking and finance, payments stand as the epicenter of innovation, driving monumental changes across the industry. As the Benelux region surges forward, banks face a critical juncture: to embrace transformation or risk falling behind. Dive into the future of finance with our groundbreaking benchmark survey – it’s time to seize the opportunity to revolutionize your payment processes and secure your competitive edge in the Benelux region.

Evolving trends

Payments have evolved from a traditional function to a forefront of innovation, driven by changing consumer behaviors and technological advancements. Banks are exploring new solutions, from contactless payments to peer-to-peer transfers, to enhance transaction speed, security, and convenience, ushering in a new era of payments innovation. Concurrently, banks face the challenge of navigating a complex regulatory landscape while adapting to digital disruptions. Regulatory compliance remains crucial, ensuring security and meeting evolving requirements. Digitalization offers opportunities for seamless payment experiences but also poses challenges within a changing competitive landscape.

This survey isn’t just about collecting data – it’s about empowering you with unparalleled insights and personalized strategies that will catapult your institution to the forefront of the industry.

Here's what's waiting for you

Unique Insights

Gain access to a personalized benchmark report, meticulously crafted to compare your institution with industry peers.

A Personal Meeting

Get ready for deep insights and actionable recommendations tailored to your institution’s unique needs presented by our expert.

Ongoing Learnings

Stay ahead of the curve with real-time access to the latest research results.

Themes of the Benchmark Survey

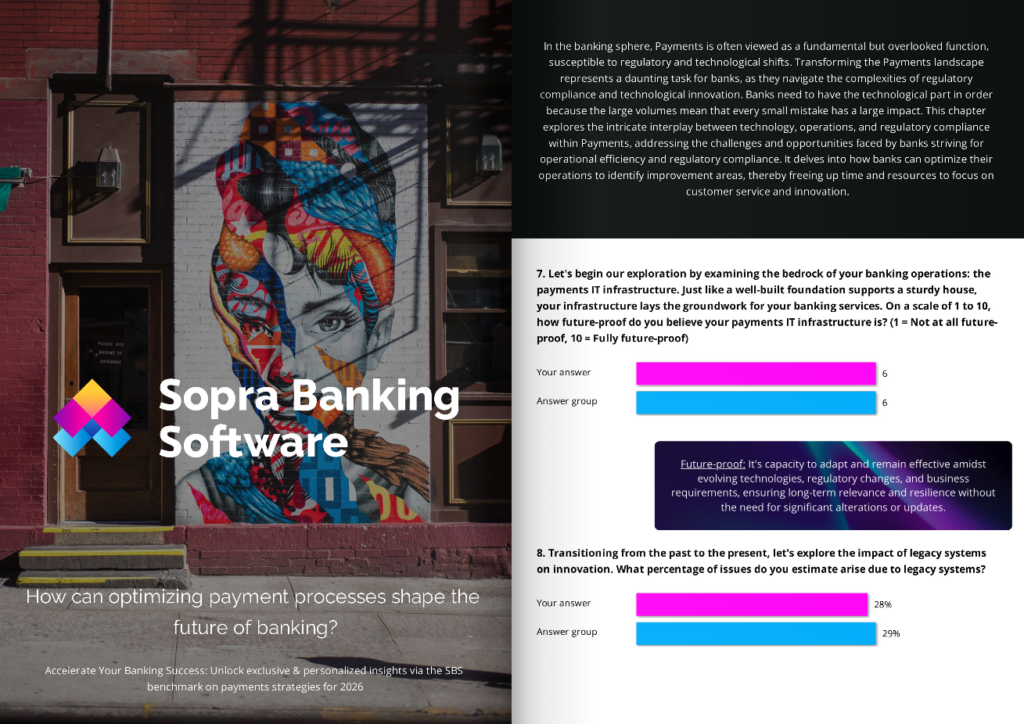

Tech, Operations, and Regulatory Compliance

The challenges and opportunities faced by banks striving for operational efficiency and regulatory compliance

Meeting modern expectations in payments

How banks can ensure their offerings meet modern customer expectations set by industry leaders

The future of payments

How will banks drive revenue and maintain competitiveness in an ever-changing landscape

About Sopra Banking Software

SBS is a trusted partner of more than 1,500 financial institutions and large-scale lenders in 80 countries worldwide, including Argenta, Crelan, Nagelmackers, NIBC, Santander, Van Lanschot Kempen and other banks. Its cloud platform offers clients a composable architecture to digitize operations, ranging from banking, lending, compliance, to payments and consumer and asset finance. Sopra Banking Software (SBS) plays a pivotal role in the digital transformation of the payments sector, managing 40% of France’s instant payments and 15% in Belgium.